property tax assistance program florida

Catholic Charities of Central Florida Inc. In Florida local governments are responsible for administering property tax.

Florida Real Estate Taxes What You Need To Know

This one varies by.

. Its Document Number is L18000163659. 888 995-HOPE - FREE foreclosure prevention counseling on the phone or online. With many people out of work due to the coronavirus COVID-19 pandemic the City Department of Finance DOF is offering several programs to assist property owners who are having a hard time making their property tax payments.

Property Tax Assistance for disabled veterans. For questions about the program call 8334930594 7 days a week from 7 am. Free foreclosure prevention workshops - check our calendar for events in your.

Heres how it works. Has the Florida company number L18000163659 and the FeiEin. HUD-approved housing counseling agencies - local agencies that provide FREE foreclosure avoidance counseling.

Florida Housings First Time Homebuyer Program is funded through the issuance of tax free mortgage revenue bonds. DoNotPay Can Help You Apply for a Property Tax Exemption for Seniors in Florida Applying for a property tax exemption is never wholly straightforward but DoNotPay can make the process easier. The guide comes with two sections.

The deadline for the first filing of the year has been pushed back a month to July 15th. The National Taxpayers Union Foundation estimates that between 30 and 60 of taxable property in the US. IRS Volunteer Income Tax Assistance VITA and Tax Counseling for the Elderly TCE Programs.

Is a Florida Limited Liability Company from TALLAHASSEE in Florida United States. If you or someone you know lost his or her job due to COVID-19 reasons the federal government offers three coronavirus unemployment assistance programs that eligible Americans could apply for. These include a tax deadline extension coronavirus relief for rent and mortgage payments student loan relief and enhanced unemployment benefits.

The Pathways to Care Program is an Essential Life Service that provides shelter and recuperative care to homeless individuals who are discharged from hospitals emergency rooms and other medical agencies. Is an Inactive company incorporated on July 6 2018 with the registered number L18000163659. Skip to main content For questions about the program call 8334930594 7 days a week from 7 am.

Mortgage Relief Program is Giving 3708 Back to Homeowners. Meanwhile you can send your letters to 1400 VILLAGE SQUARE BLVD SUITE 3 TALLAHASSEE FL 32312. Check Your Eligibility Today.

In many states tax agencies impose property taxes on personal property. Lived on your property for at least two years prior to your application date Cant have received financial assistance within the last five years from the Affordable Housing department through another program Current on your existing mortgage and property taxes Income eligible up to 120 Area Median Income AMI depending on fund source. By using our programs borrowers are receiving the benefit of a lower interest rate than the private market offers.

Find out if your homes location and project qualify. Additionally many states including Florida offer some homeowners property tax relief programs that allow them to reduce their annual or semiannual real property tax payments. Ad Homeowners Relief Program is Giving 3708 Back to HomeownerCheck Your Eligibility Today.

Most states provide low income families with free advice as part of the federal government funded Legal Services Corporation LSC. The state for this company is FloridaThere are 1 directors of this company. This also includes widows and widowers who can get an exemption of up to 500.

Ad Homeowners Relief Program is Giving 3708 Back to HomeownerCheck Your Eligibility Today. STATE OF FLORIDA PROPERTY TAX ASSISTANCE PROGRAM LLC. The homestead exemption and Save Our Homes assessment limitation help thousands of Florida homeowners save money on their property taxes every year.

STATE OF FLORIDA PROPERTY TAX ASSISTANCE PROGRAM LLC. Skip to main content. Established under Section 3206 of the American Rescue Plan Act of 2021 HAF provides 676102379 in financial assistance to the state of Florida through the United States Department of the Treasury.

OUR Opportunities for Utilities and Rental Assistance Florida Program is Floridas federally-funded emergency rental assistance relief program. Eligible Florida renters are entitled to up to 15 months of rent and utility payments. Our app can check your location and give you customized advice on what exemptions are available in your area.

Visit HUDgovcoronavirus to find the latest information and resources for service providers homeowners renters and grantees. In addition each client is offered mental. Such as 2020 tax filings a W-2 or 1099 from your employer or other proof of income.

Apply for the Florida PACE Program. Hundreds of areas and project types do Submit an application and get a pre-approval in minutes. Principal address is 1400 VILLAGE SQUARE BLVD SUITE 3 TALLAHASSEE FL 32312.

About Us Contact Us Contact a County Official. Qualifying buildings include garden high-rise townhouses. These include exemption programs to lower the amount of taxes owed standard payment plan options as well as the new Property Tax and Interest.

The companys registered agent is REGISTERED AGENTS INC 7901 4TH STREET NORTH. For more information please view the Florida Homeowner Needs Assessment and Plan. Discover local opportunities or log in to access resources.

STATE OF FLORIDA PROPERTY TAX ASSISTANCE PROGRAM LLC. DEO has been designated to manage and operate HAF on behalf of the state of Florida. The company is INACTIVE and its status is ADMIN DISSOLUTION FOR ANNUAL REPORT.

Homeowners Relief Program is Giving 3708 Back to HomeownerCheck Your Eligibility Today. Florida - A homestead exemption of up to 50000 is in effect for a primary home. Ex-service members and veterans may receive savings as well as disabled military members.

This Florida Limited Liability company is located at 1400 VILLAGE SQUARE BLVD SUITE 3 TALLAHASSEE FL 32312 US and has been running for four years. Further benefits are available to property owners with disabilities senior citizens veterans and active. The Department of Revenues Property Tax Oversight p rogram provides oversight and assistance to local government officials including property appraisers tax collectors and value adjustment boards.

The second filing is September 15th. Check Your Eligibility Today. A Housing Credit allocation to a development can be used for 10 consecutive years once the development is placed in service and is designed to subsidize either 30 percent the 4 percent tax credit or 70 percent the 9 percent tax credit of the low-income unit costs in a development.

The process to do this may vary but a good checklist can help you get on your way. A lawyer may be able to help a homeowner enter into a payment program. AARP Foundation Property Tax-Aide is a free program that helps eligible homeowners and renters in select states apply for property tax relief.

Another possible source of assistance in dealing with back property taxes may be a free pro-bono attorney. Help people in your communities get property tax relief. Was filed on 06 Jul 2018 as Limited Liability Company type registered at 1400 VILLAGE SQUARE BLVD.

In a few simple steps you could be getting started on your home improvement project. Learn how you can get money back on your property taxes. Stay up to date on all COVID19 information related to HUD programs.

Select Your Preferred Contractor. Property owners in Florida may be eligible for exemptions and additional benefits that can reduce their property tax liability. Blind persons and disabled may receive 500 as well.

The STATE OF FLORIDA PROPERTY TAX ASSISTANCE PROGRAM LLC. Region IVs Affordable Rental Housing and. STATE OF FLORIDA PROPERTY TAX ASSISTANCE PROGRAM LLC.

Ad 2022 Latest Homeowners Relief Program. Steps to take - act now if you think you will be unable to pay your mortgage. SUITE 3 TALLAHASSEE FL 32312.

The Florida State Constitution gives local government tax agencies the legal rights to assess property. Mortgage Relief Program is Giving 3708 Back to Homeowners. It currently has one Authorized Member.

Check If You Qualify For 3708 StimuIus Check. If you think your homes latest assessment value is too high you can file an appeal that challenges your tax assessment.

Florida Property Tax H R Block

Florida S State And Local Taxes Rank 48th For Fairness

Top 10 Best States For Disabled Veterans To Live 100 Hill Ponton P A

Reduce Texas Soaring Property Taxes By Embracing Sound Budgeting

Florida Tax Information H R Block

Soaring Home Values Mean Higher Property Taxes

Florida Homestead Exemption How It Works Kin Insurance

Six Ways You Can Legally Avoid At Least Part Of Your Florida Property Tax Bill

Property Tax Orange County Tax Collector

How Taxes On Property Owned In Another State Work For 2022

What Is Florida County Tangible Personal Property Tax

San Diego County Property Taxes 2022 Ultimate Guide What You Need To Know Rates Lookup Payments Dates

Top 10 Best States For Disabled Veterans To Live 100 Hill Ponton P A

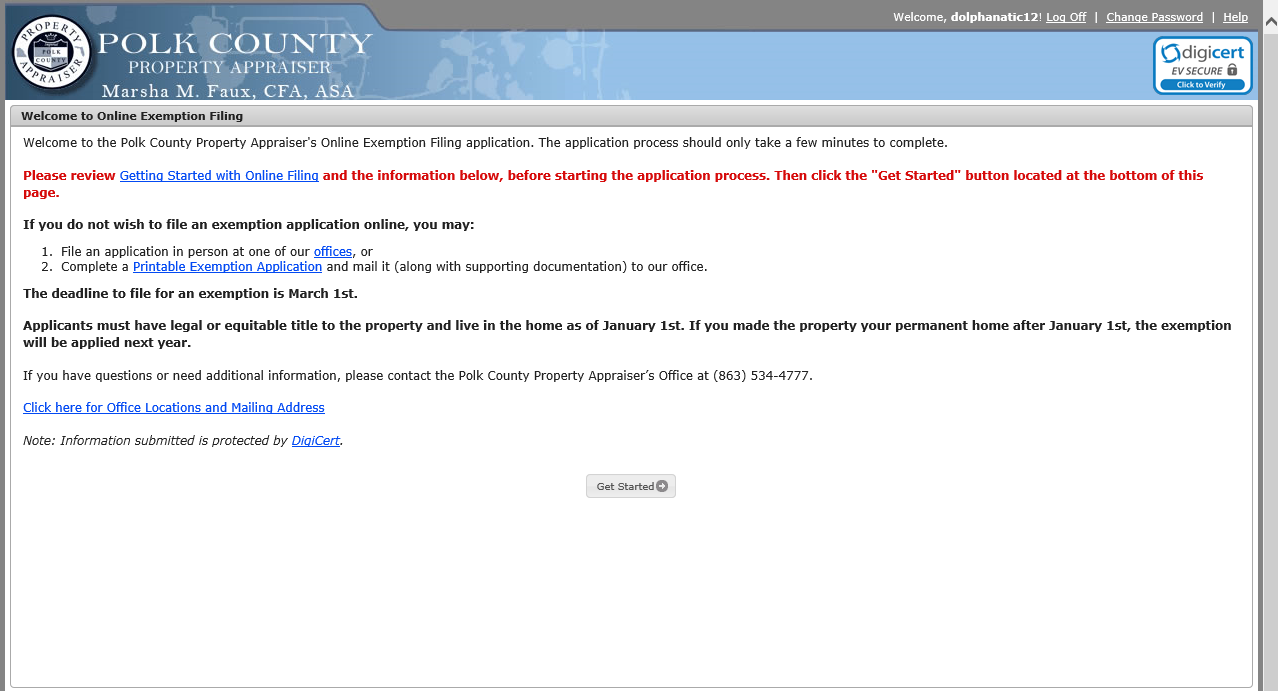

Filing An Exemption Application Online

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/GettyImages-77332455-577f3a8c5f9b5831b5dd010f.jpg)

What Is A Property Tax Circuit Breaker

How Florida Property Tax Valuation Works Property Tax Adjustments Appeals P A

What Is A Homestead Exemption And How Does It Work Lendingtree

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)